In the realm of Indian employment, bank jobs have always held an esteemed position. They are not just about financial transactions but embody the promise of stability, growth, and respect within society. The demand for bank personnel has skyrocketed, thanks to the expanding financial sector and the government’s continuous push for inclusivity in banking services. Consequently, bank exams serve as a gateway for millions of aspirants seeking a career in this promising domain. Understanding the nuanced eligibility criteria, application processes, and preparation strategies is critical for forging a successful path to a bank job.

Background and Purpose of Bank Exams

Bank examinations in India serve as a pivotal mechanism for recruiting candidates into various public sector banks, as well as the private banking sector. These exams assess a candidate’s aptitude, knowledge, and skills necessary for performing various roles in a bank, such as probationary officers, clerks, and specialist officers. The need for a structured examination process stems from the necessity to ensure that the personnel hired are equipped not only with academic knowledge but also with the practical, critical thinking abilities essential for navigating the complexities of banking operations.

As financial institutions increasingly transition into digital platforms, there’s an added emphasis on equipping candidates with the necessary technological skills. This evolution in banking has resulted in an expanding array of roles—from customer service to investment management—each requiring specific knowledge and competencies. Employers seek candidates who are not just academically accomplished but are also agile learners, able to adapt to new tools and methodologies that define modern banking.

Moreover, the banking sector holds immense potential for career growth. Once you clear a bank exam and secure a position, there are planty opportunities for advancement, enabling employees to move into more specialized or managerial roles. This career trajectory makes it all the more essential for aspiring candidates to understand the intricacies of bank exams and tailor their preparation accordingly.

Step-by-Step Explanation of the Application or Preparation Process

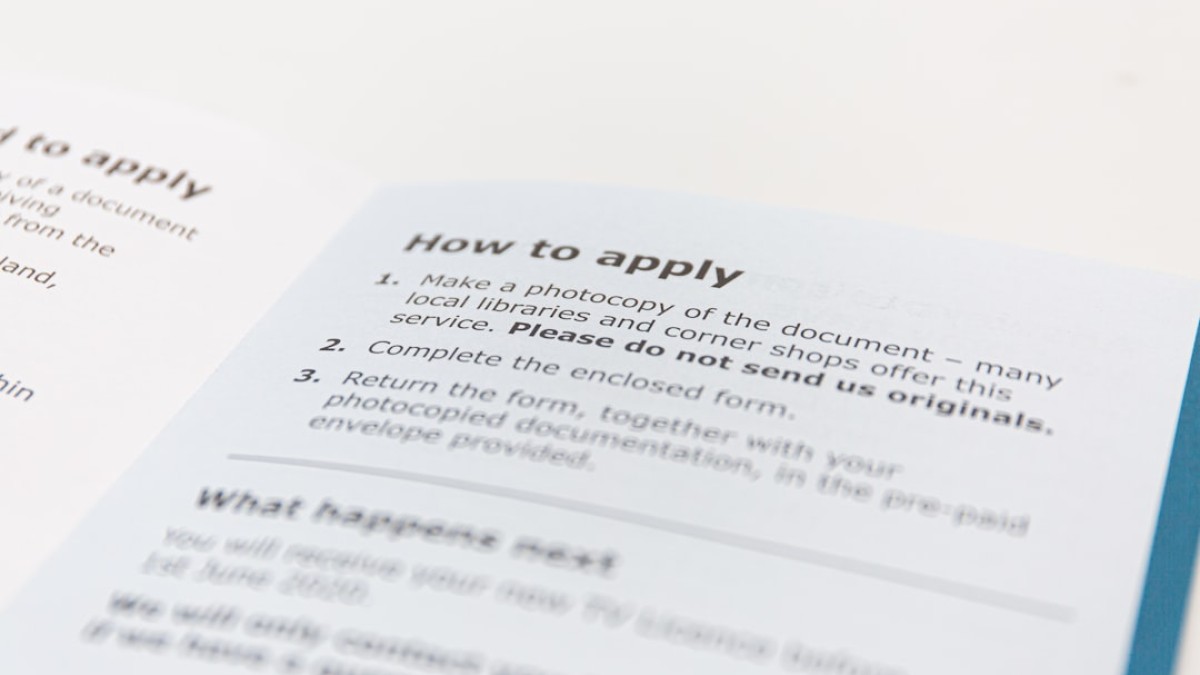

The journey toward obtaining a coveted position in banking begins with the examination. The application process may seem daunting, but it can be navigated effectively with a well-defined strategy. Firstly, candidates must stay informed about announcements and notifications pertaining to various bank exams, which are generally published on the official websites of the respective banks as well as on several competitive exam portals.

The first step in this journey is to gather the necessary documentation required for the application. Typically, candidates will need to provide proof of educational qualifications, age, and sometimes even community certificates if claiming reservations. It is wise to have electronic copies of these documents and recent passport-sized photographs ready for submission during the online application process. Filling out the application form requires careful attention since any discrepancies can lead to disqualification; hence reading all instructions thoroughly is imperative.

Once the application is submitted, candidates must focus on preparation. This phase varies significantly based on individual styles and preferences but generally involves reviewing the syllabus and developing a study plan. It is advisable to allocate specific time blocks for different subjects such as Quantitative Aptitude, Reasoning Ability, English Language, and General Awareness.

Many candidates also consider enrolling in coaching institutes to benefit from structured guidance and peer support, although self-study can be equally effective with the right resources. Online platforms and mobile applications have revolutionized how candidates prepare, providing access to practice tests, sample papers, and video lectures 24/7. Another critical aspect during this phase is to regularly review current banking and economic affairs, as these topics hold considerable weight in various banking exams.

Eligibility Criteria, Age Limits, and Documentation

Understanding the eligibility criteria is crucial for any aspirant aiming for bank examinations. While specific requirements may vary slightly from one bank to another, several core eligibility benchmarks are commonly established. The age limit for most banking exams generally ranges from 20 to 30 years for probationary officers, with relaxation based on categories or educational qualifications. For clerical positions, the age limit is often similar, but again, there are specific relaxations available for candidates from reserved categories.

Educational qualifications stand as a non-negotiable criterion. For the clerical positions, candidates typically need to possess a graduate degree in any discipline from a recognized university. However, for roles requiring more specialized knowledge—such as specialist officers—additional qualifications relevant to the field are mandated. Aspiring candidates should always verify the necessary educational requisites from the notifications pertaining to the respective bank exam they are interested in, as ambiguity in this matter can lead to frustrations later in the process.

Apart from age and educational qualifications, candidates must be citizens of India, or hold certain citizenship statuses as defined in the exam notifications. Documentation is a critical aspect of the eligibility criteria. Generally, aspirants need to submit age proof, academic credentials, and in some cases, community certificates to avail of reservations. Therefore, candidates must ensure that all documents are readily available and in order before applying, as any errors can delay the process or compromise eligibility altogether.

Syllabus Breakdown, Exam Pattern, and Preparation Strategy

The syllabus for bank exams can be expansive, covering various sections that test diverse skills. Generally, the primary areas include Quantitative Aptitude, Reasoning Ability, English Language, General Awareness, and Computer Knowledge. Each of these sections has its own intricacies and demands specific focus during preparation. For instance, Quantitative Aptitude requires not only a robust mathematical foundation but also the ability to solve problems quickly under pressure. Preparation should, therefore, prioritize understanding formulas, practicing problem sets, and improving calculation speed.

The Reasoning Ability section assesses logical thinking and problem-solving skills. Candidates should familiarize themselves with various types of logical puzzles, syllogisms, and blood relations, as these are commonly tested components. As for the English Language section, not only must candidates possess a strong vocabulary, but they’re also required to understand grammatical rules and comprehend passages efficiently. Regular reading of newspapers and novels can significantly aid in improving language proficiency.

In addition to theoretical studies, a structured preparation strategy should also incorporate time management. Practice tests are a pivotal component in this regard, helping candidates understand how to pace themselves during the actual exam. Simulating the exam environment can help in building the requisite stamina and focus, enabling candidates to perform remarkably on exam day.

Another essential aspect of preparation is keeping abreast with current affairs, particularly regarding banking and finance. Various online resources and journals can help candidates stay informed. Cracking bank exams requires not only hard work but also smart work. By combining rigorous study with ongoing assessments, candidates can accurately gauge their growth and areas needing improvement, ensuring a well-rounded preparation strategy.

Result Declaration Process, Cut-Off Interpretation, and Final Selection

Once the exams conclude, results are typically announced within a set timeframe, reflecting both transparency and efficiency in the recruitment process. Candidates can access their results through official websites, where they often have to enter their roll number and other details to view their scores.

Interpreting cut-offs, which are the minimum marks required to qualify for the next stage, can be a point of anxiety for many candidates. These cut-offs vary annually based on several factors: the number of candidates, the difficulty level of the exam, and the overall performance of applicants. Understanding how cut-offs function offers candidates a clearer perspective on their standing and future actions.

After declaring the results, the successful candidates usually undergo one or more levels of interviews, which could range from a personal interview to group discussions, depending on the role they have applied for. The final selection process integrates exam performance and interviews, emphasizing the importance of both aspects. Those who secure the requisite scores in both would typically be offered a position, which might lead to further training and eventual placement in bank branches across the country.

For those aspiring for a career in banking, it’s crucial to approach this process with confidence and diligence. The integration of written exams and subsequent interviews serves as a comprehensive lens into each candidate’s capabilities and potential fit within the banking sector.

Real-life Implications and Post-Selection Job Roles

Being selected for a bank job can be a life-altering event for many candidates. The implications go beyond just financial stability; they offer a sense of achievement coupled with numerous opportunities for personal and professional development. Once candidates secure positions, they often find themselves in roles that offer a blend of customer interaction, analytical tasks, and administrative responsibilities.

Probationary Officers, for instance, are often rotated across various departments, enabling them to acquire a well-rounded understanding of the bank’s operations. This exposure can lead to advanced career opportunities, as department heads and executives often hail from ranks of PO-level employees. Clerical positions, while seemingly limited in scope, can also pave the way for specialization in areas such as loan processing, customer relationship management, and financial advisory roles.

Post-selection training is a standard procedure in many banks, assuring candidates are well-prepared to navigate their roles effectively. This training often includes not just job-specific skills but also components such as ethics, customer service, and evolving banking regulations.

Moreover, within the banking ecosystem, employees are encouraged to continuously enhance their knowledge and skillset. The emphasis on ongoing education manifests in opportunities for further certifications and specialized courses. As regulations and technological advances redefine the banking landscape, staying updated becomes imperative for professional growth.

In conclusion, the path to securing a bank job in India is not merely about clearing an exam but about understanding the nuances involved in the broader job recruitment ecosystem. Encouraging aspirants to not just aim for scores but to embrace the entire process puts them in a better position to succeed, both in the exams and in their future careers. With determination, guided preparation, and a commitment to continual learning, candidates can undoubtedly unlock many doors of opportunity in the vibrant field of banking.