As the world becomes increasingly digital, the realms of finance and banking are not just keeping pace but are also transforming at a breathtaking velocity. The online Know Your Customer (KYC) process, a regulatory requirement that aims to verify the identity of clients, has emerged as a cornerstone in the digital finance landscape. This article aims to provide a comprehensive exploration of the online KYC process, delving into its real-life financial applications, the challenges faced by users, regulatory perspectives, and its promising trends and technologies shaping the future.

Understanding the Basics of KYC

At its core, KYC involves the methods that financial institutions use to verify the identities of their customers. This process usually encompasses the collection of personal information like name, address, and date of birth, complemented by verification through government-issued identification and proof of address. The primary aim is to prevent identity fraud, money laundering, and terrorist financing, ensuring that financial systems remain secure and robust.

KYC norms received significant emphasis post the 2008 financial crisis, when regulatory bodies worldwide realized the dire need for better identification processes. In India, the Reserve Bank of India (RBI) has laid down clear guidelines for KYC procedures, mandating that all banks and financial institutions adhere to these protocols strictly. The emergence of digital technologies brought the online KYC process into the spotlight, and this transition has had profound implications for both consumers and businesses. With the Internet making it easier for people to access financial services, the necessity of a streamlined, user-friendly KYC process has never been more pronounced.

The Real-Life Financial Scenarios of KYC

Imagine Rohan, a 30-year-old software engineer based in Bangalore, keen on investing in mutual funds through an online platform. Rohan’s path is riddled with possibilities, but before he can begin this journey, he must complete the KYC process. In the traditional banking model, this process would involve multiple visits to various offices, yet through the digital lens, it becomes a swift online experience. Rohan simply uploads a scanned copy of his Aadhar card and utility bill, clicks ‘submit,’ and awaits verification. In less than 24 hours, he receives notification that his KYC has been successfully completed. The empowerment of technology not only facilitates Rohan’s desire to make astute financial decisions but also reflects how KYC can streamline user experiences in a multifaceted digital ecosystem.

On the other hand, consider Meera, a small business owner in Mumbai who operates a coffee shop. Although she has been compliant with all business regulations, her attempt to open a corporate bank account becomes a Herculean task. Her experience with KYC highlights the inefficiencies that can arise even in a digital system. Meera’s struggle lies in the various documents required by the bank, some of which are not readily available in a digital format. This scenario underscores a common public sentiment: despite the convenience promised by digital banking, the KYC process can sometimes feel cumbersome, often exacerbated by unclear guidelines from financial institutions.

Practical Implementation of Online KYC

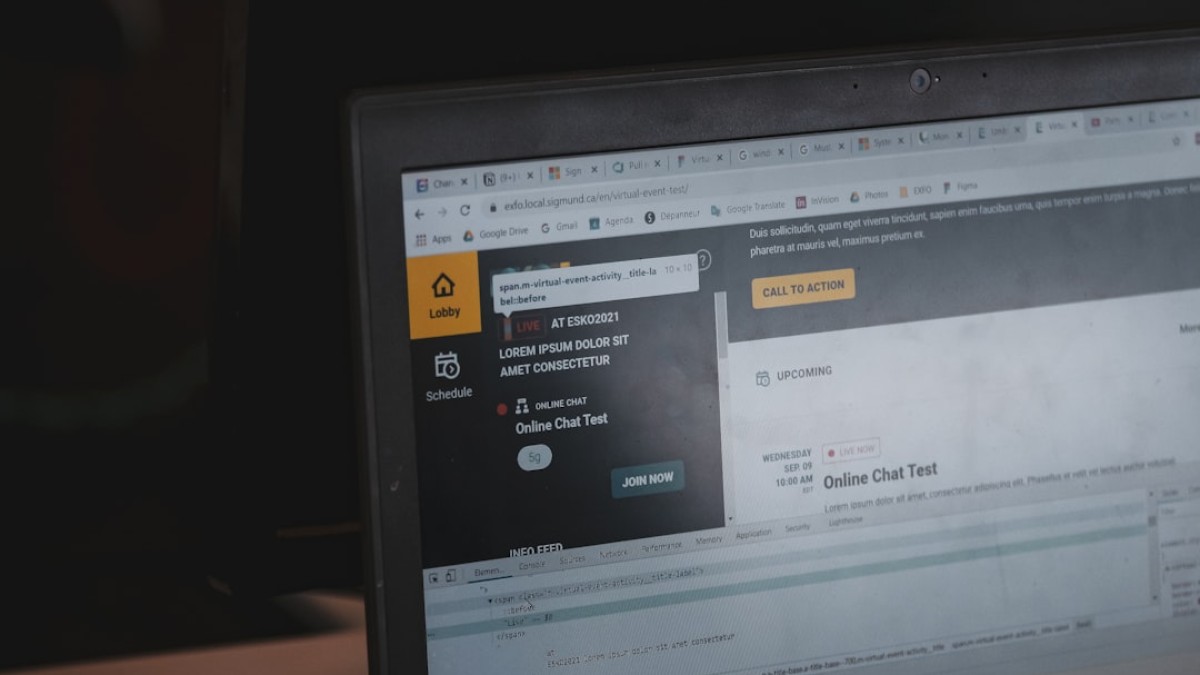

The implementation of online KYC systems varies among banks and platforms in India, with several fintech companies taking the lead in creating user-friendly interfaces. The adoption of technology such as Artificial Intelligence (AI) and Optical Character Recognition (OCR) has simplified documentation efforts for banks, helping them to automate identity verification and improve customer experiences. Take, for instance, the Unified Payments Interface (UPI), which has revolutionized financial transactions in India. UPI integrates KYC processes effectively, enabling users to register bank accounts, link multiple accounts, and authenticate themselves using biometric verification. This seamless integration demonstrates not just the potential of technology in enhancing banking efficiency, but also serves as a testament to how financial institutions can leverage such innovations to capture an evolving market.

Despite the advantages, discrepancies in documentation requirements can still pose challenges. Many users report delays in KYC verification due to image quality issues or even the unavailability of specific identification documents. Banks may also have different requirements regarding proofs of identity and address, leading to confusion. To address these issues, institutions can design more unified guidelines that standardize documentation requirements across the board. Additionally, the deployment of interactive AI-driven chatbots can guide customers through the KYC process, clarifying points of confusion and providing real-time assistance. Such innovations could ultimately streamline KYC procedures, making the user experience smoother while speeding up the verification process.

Regulatory Perspectives and Compliance Framework

In the Indian context, the RBI plays a pivotal role in formulating KYC norms for banks and lending institutions. The RBI mandates compliance with the guidelines laid out under the Prevention of Money Laundering Act (PMLA), 2002. The act is designed to prevent identity theft, fraud, and illicit transfers, holding institutions accountable for due diligence in customer onboarding.

While banks are required to perform KYC checks before providing services, they must balance compliance with consumer convenience. This brings to the forefront the critical importance of secure data management practices. With increasing concerns about data privacy and cybersecurity threats, the regulatory framework around KYC must also evolve. Stringent penalties for non-compliance, including the risk of losing a bank’s license, compel institutions to invest in secure digital infrastructure.

Furthermore, regulatory bodies must proactively engage with fintech companies to ensure that emerging technologies align with the legal requirements. Collaboration between regulators and tech platforms can usher in innovative solutions, such as biometric data or facial recognition, legitimizing and accelerating the onboarding process without compromising on security. For instance, the Aadhaar-based eKYC has been a cornerstone innovation facilitating electronic verification, although its use has also spurred debates about privacy and data protection.

Common Issues Faced by the Public

One reality that emerges in discussions about online KYC is that while technology can simplify processes, it can also introduce a range of complications. Users, like Rohan and Meera, frequently encounter issues that hinder their interactions in the digital financial landscape. A common sentiment is frustration stemming from the ambiguity surrounding documentation. Many individuals are uncertain about which documents are acceptable for verification, creating barriers even before the KYC process begins.

Technical glitches can further exacerbate these problems. Users sometimes find themselves unable to upload documents due to server outages, software bugs, or insufficient file sizes. Moreover, instances of identity theft raise alarms about the safety of sharing personal information online. With several high-profile data breaches in recent years, it is crucial for users to remain diligent about the platforms where they submit their data.

To mitigate these issues, stakeholders in the financial ecosystem must invest in outreach initiatives that educate customers about KYC processes. A proactive approach can demystify the requirements and foster trust between banks and customers. Additionally, increasing the transparency of the KYC process, through features like application tracking, can significantly enhance user satisfaction and engagement.

The Role of Technology in Future KYC Practices

Looking ahead, it is undeniable that technology will play an essential role in shaping the future of KYC practices. Already, we observe the emergence of blockchain technology, which promises to create decentralized ledgers that securely log transaction and identification data. This development could significantly enhance the reliability and efficiency of KYC processes. With blockchain, customers will have more control over their data while ensuring their privacy, something that has become increasingly valued in today’s digital age.

AI and machine learning are also on the horizon, shaping smarter KYC systems that can analyze user behavior patterns and automatically flag anomalies. As these technologies continue to advance, they can also help create more adaptive KYC processes. For instance, if a returning customer consistently updates their information, the system could become more lenient, requiring fewer documents in subsequent interactions. This not only leverages existing data but also fosters an environment where financial institutions can build long-term relationships with clients based on their behavior.

Automated verification will also be a game-changer, especially for small businesses like Meera’s coffee shop. With fewer human touchpoints, transactions can be processed more rapidly, helping businesses operate more efficiently. However, the need for regulations will remain paramount in watchdogging these advancements as they can lead to systemic risks if not regulated effectively. The collaboration between regulatory authorities and fintech innovators will be crucial in developing frameworks that prioritize both innovation and accountability.

Conclusion: A Balancing Act of Security, Convenience, and Innovation

The online KYC process represents both the challenges and opportunities in the evolving digital banking and finance landscape. As Rohan discovers the benefits of swift digital engagement, Meera highlights the frustrations that can arise due to discrepancies in processes. These dual narratives underscore the need for an adaptive framework that balances security, convenience, and innovation.

Continuous education and the implementation of user-friendly, tech-driven systems will form the cornerstone for enhancing customer experience. Regulatory bodies must remain ardently engaged with the technological evolution of financial services while upholding standards that ensure data protection and minimize fraud. As technology emerges as a differentiator in financial services, its potential to reshape KYC processes cannot be overstated.

The journey towards a robust online KYC process is not without its bumps, but navigating this digital frontier paves the path for a broader, more inclusive approach to finance. By fostering an ecosystem built on transparency, education, and technological innovation, stakeholders in the financial landscape can ensure that the benefits of digital banking extend to all, creating a more empowered financial future for individuals, businesses, and the economy at large.